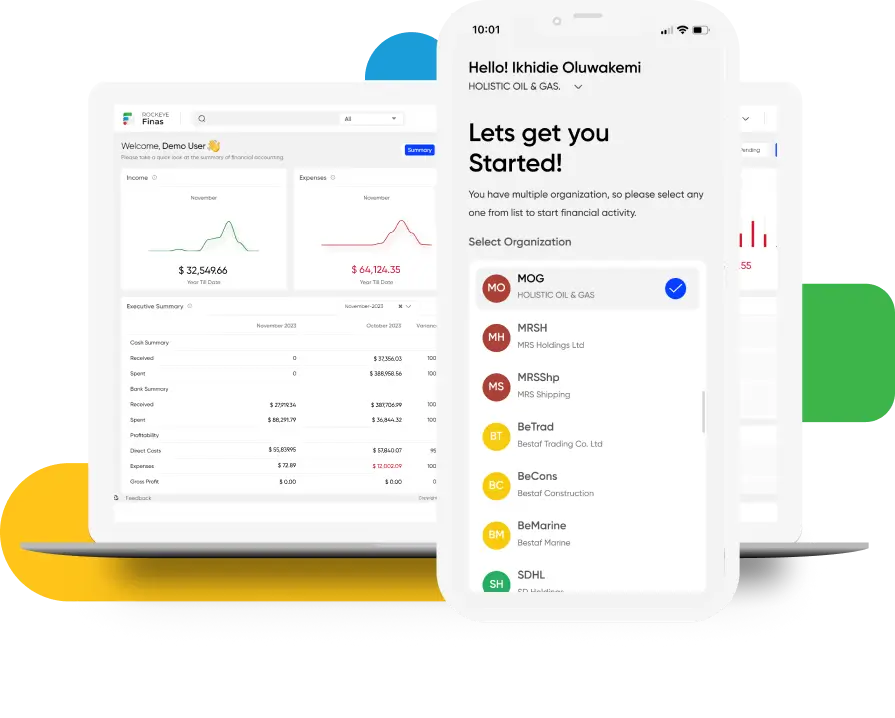

Rockeye Financial Accounting

Seamlessly integrate and automate financial management with an AI-powered solution, covering payables, receivables, assets, expenses, and reporting for comprehensive financial insights.

Rockeye is a robust comprehensive suite of business solutions

Designed to streamline and automate business processes, Rockeye integrates key functions like real-time data analytics, customizable templates, and AI-driven insights for more efficient decision-making.

With seamless system integration and a focus on improving operational efficiency, Rockeye empowers businesses to scale while ensuring compliance and transparency. Trusted by organizations globally, it is a reliable platform that helps businesses optimize performance and drive sustainable growth.

More Features

Financial Accounting

Enhanced Control

Integrated Systems

Optimize operations to facilitate seamless collaboration & data integration.

Streamlined Reconciliation

Streamline and accelerate reconciliation processes with our automated accounting & financial software.

Automation

Traceability Assurance

Our solution guarantees a transparent audit trail, promoting transparency and accountability in your financial processes.

Workflow Flexibility

Tailor workflow to suit your specific processes, ensuring adaptability to changing business needs & operational preferences.

Scalability

Real-time Monitoring

Maintain real-time monitoring of accounting operations with immediate financial insights.

Advanced Reporting

Access detailed reports for insightful analytics, empowering strategic planning and informed decision-making.

Mobile Accessibility

Compliance Agility

Navigate regulatory requirements smoothly, ensuring compliance effortlessly for a harmonious environment.

Simulation Insights

Leverage valuable insights through simulations, facilitating strategic decision-making.

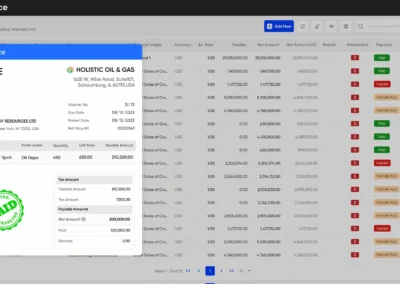

Manage Daily Sales Invoice Update in One-System

Create as many templates as you need for frequently used documents, and schedule all recurring transactions for future periods. Improve productivity and efficiency in daily routines with a few simple actions.

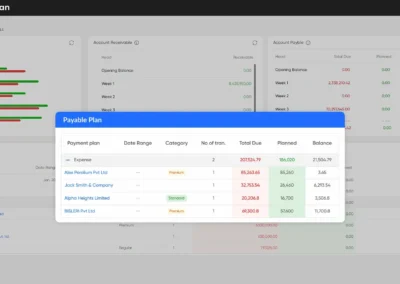

Payment Plan

Explore the Payment Plan, Which showcases a monthly breakdown of fund movement based on accounts receivable and accounts payable. Drill down to a weekly perspective to gain insights into fund dynamics. This clear visualization aids in making informed decisions for future expansion opportunities.

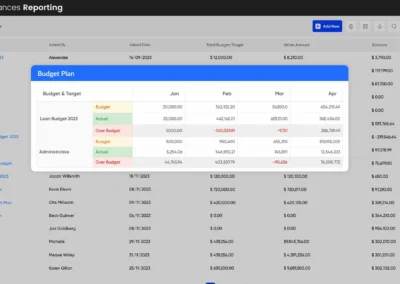

Budget Balances Reporting

Explore the simplicity of budget planning within our system, where users can check budget balances through intuitive reporting. This snapshot highlights the user-friendly approach to managing and monitoring budgets, empowering users to make informed financial decisions effortlessly.

Stakeholders

Streamlined Financial Accounting Solution, Empowering Business Expansion.

Management

Lead confidently with FINAS – gain real-time insights, strategic oversight, and a comprehensive overview of financial performance.

Account Receivable

Boost cash flow, enhance receivables management – your financial health in your hands.

Account Payable

Take charge of payment efficiency, regain oversight of expenses – FINAS, your dependable partner in accounts payable.

Treasury

Effortlessly manage treasury complexities – FINAS ensures liquidity, risk management, and financial flexibility.

Auditor

Navigate audits effortlessly – FINAS offers transparency, accuracy, and compliance for your financial reviews.

Explore the Essential Features

For your financial accounting solution. Maximize efficiency in financial tasks with our customized accounting solution, offering accuracy, flexibility, and specialized functionalities to elevate business productivity.

BPMN Approval System

Ensure financial precision and regulatory compliance with our two-step authorization procedure.

Audit & Activity Log

Boost openness, responsibility, and protection with our vital Audit Trail feature.

Multi-Currency Support

Confidently handle global transactions with robust support for multiple currencies, facilitating seamless international operations.

Bank & Cash Transaction

Accurately document ongoing financial transactions in real-time, promoting transparency and efficient cash flow management.

AR & AP Streamlining

Improve revenue inflows with effective management of Accounts Receivable and meticulous handling of expenses via Accounts Payable.

Fund Allocation

Simplify payment allocation for precise tracking, ensuring transparency and accurate expense attribution.

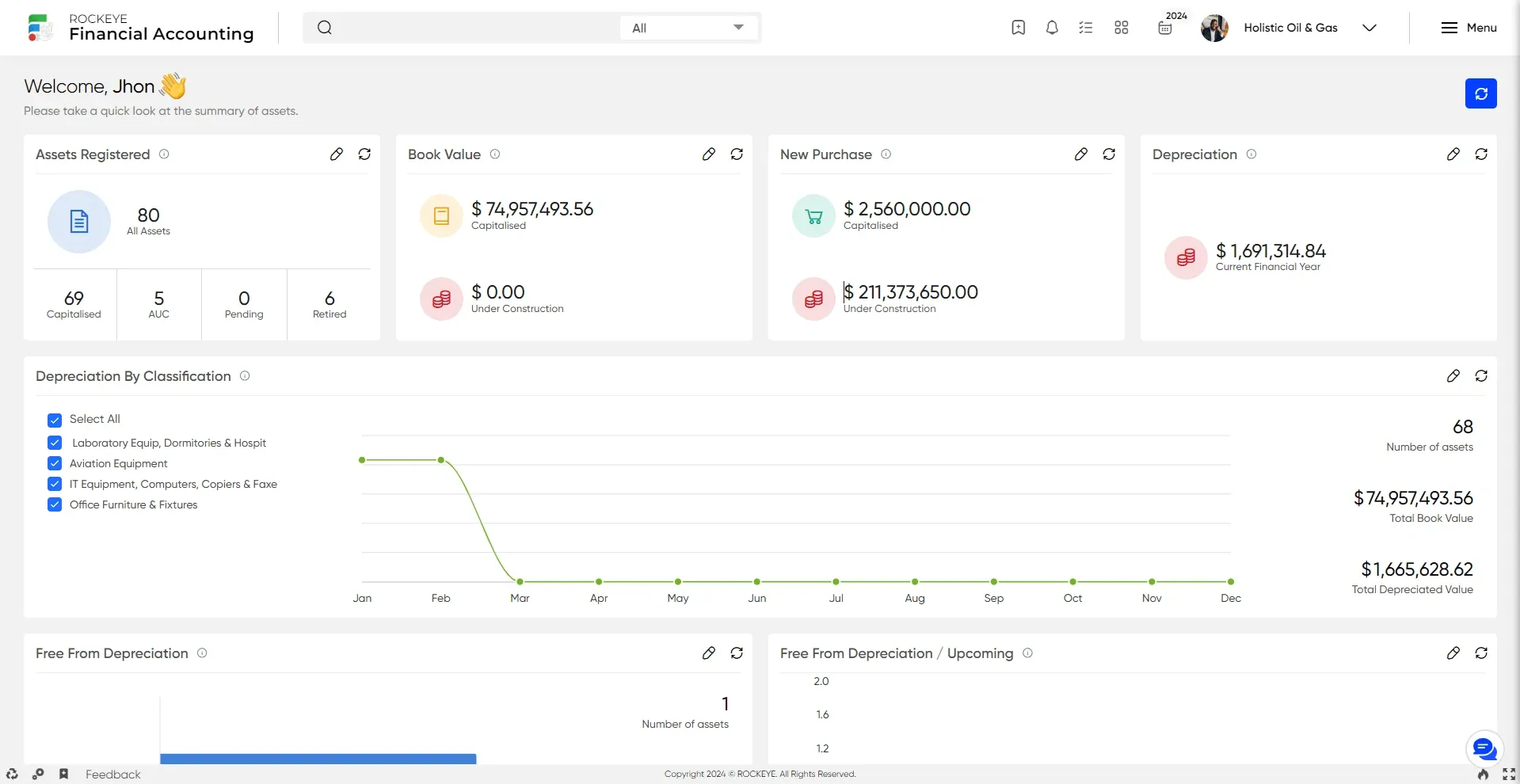

Fixed Asset Accounting

Enhance asset valuation through structured methods of depreciation, assessment, and appreciation, aiding informed decision-making.

Customer / Vendor Dashboard

Empower your business with in-depth insights into transactions, payment trends, and credit statuses.