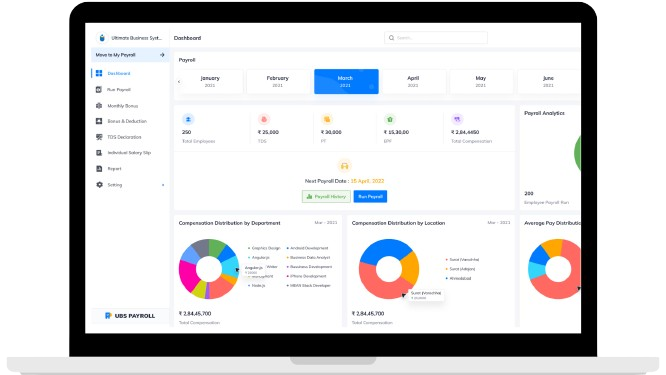

UBS Payroll Software

As a market leading Asia payroll software provider with over 30 years of product development, we deliver compliant, intuitive, and extensible software that supports a diverse range of business structures.

What’s in UBS Payroll?

Fully integrated with UBS Accounting Software. Secure your employee data appraisals, leaves, absences, holidays, job, and salary history in one place.

Payroll

- 1st & 2nd half

- Payslip formats

- Email Payslip

- Mgmt Report

- Bonus, Loan

- Advance, OT

Human Resource

- Leave

- Training

- Appraisal

- Employees info

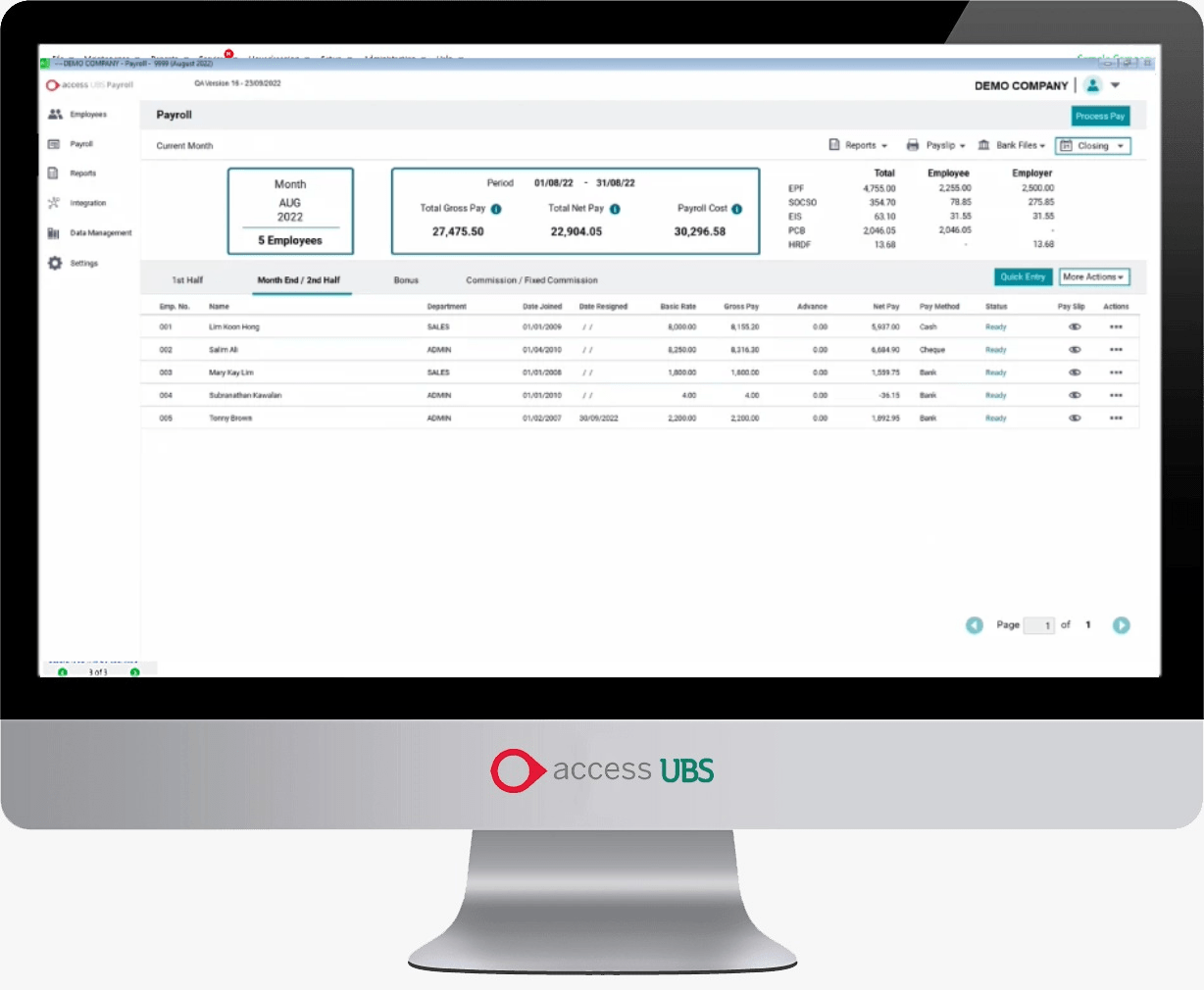

Statutory

- EPF

- Socso

- EIS

- PCB

- HRDF

- Zakat

Employees

The employee management feature enables users to easily add, delete or make changes to employee records. Employee information can also be accessed quickly with the search tool which allows employees to be searched by name, department or job title.

Payroll

Process payroll efficiently and accurately. The entire payroll process – data preparation, payroll processing, report generation, and payslip printing – can be completed end-to-end within a single screen.

Report

Retrieve payroll information easily with Access UBS Payroll’s report feature. Employee, payroll, statutory and bank reports are grouped and centralised, enabling users to access the required information conveniently.

Integration

Access UBS Payroll’s data integration capabilities enable data to be easily imported for payroll processing. Payroll information can also be posted seamlessly to Access UBS Accounting.

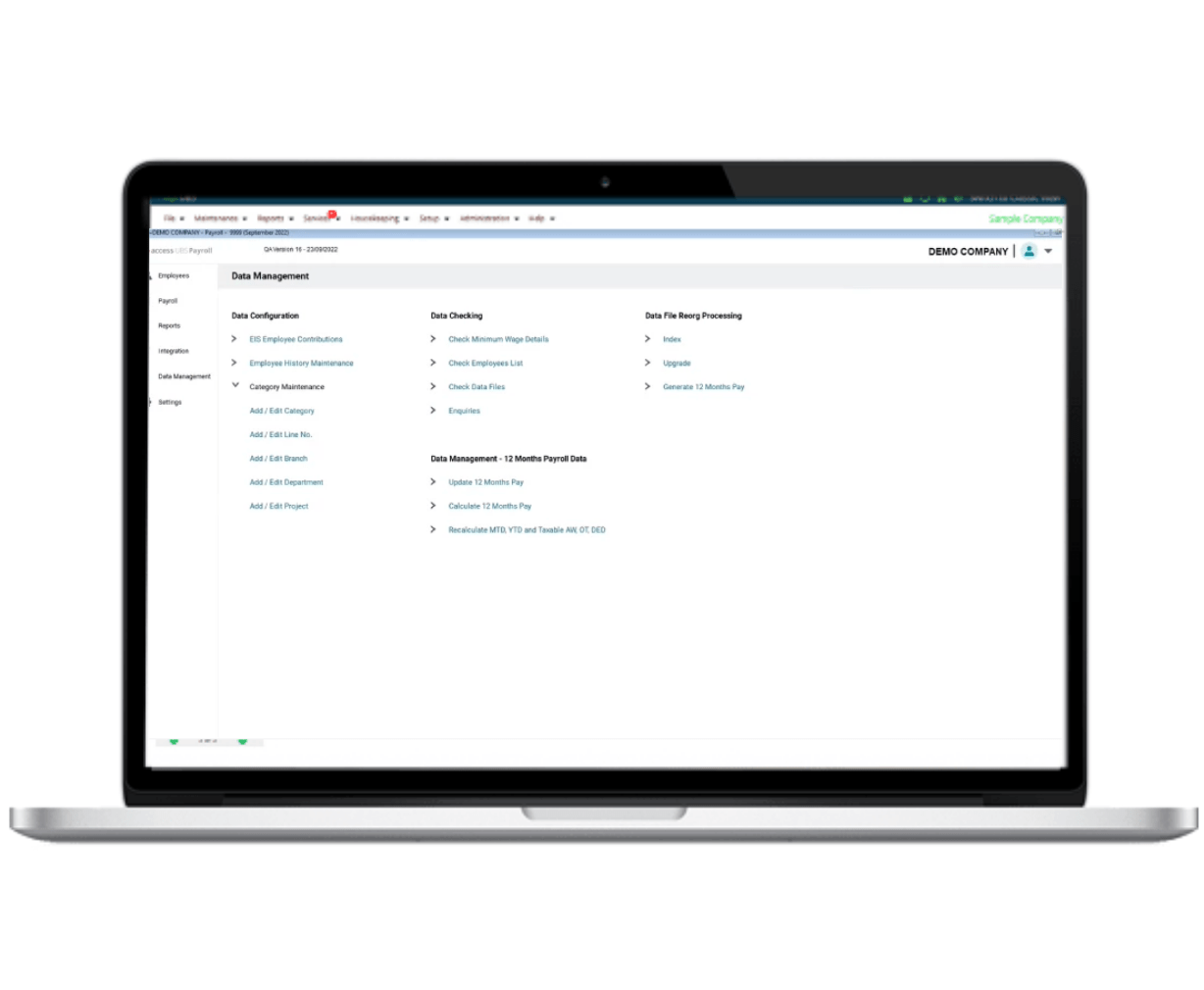

Data Management

Manage your company’s payroll data with ease. Configure payroll data, perform data checks and maintain payroll categories easily with Access UBS Payroll’s Data Management functionalities.

Settings

Leverage the Settings function in Access UBS Payroll for greater security and user control. You can also change payroll and bank settings to align with your company’s requirements.

Payroll Training Courses

Access Payroll training courses are facilitated by product experts and experienced professionals who have in-depth knowledge in software implementation and best industry practices. Expand your knowledge base and advance your skills by attending yearly workshops or webinar sessions.

Harness the power of UBS Payroll now

- Quick and easy setup

The installation process for Access UBS Payroll is simple. Set-up wizards and built-in help centre features are also available to guide users during installation. - Expert help and support

Though Access UBS Payroll is an easy-to-use solution, we understand you might need a helping hand now and then. Our customer support team are on-hand to assist you via phone or email.

What’s in UBS Payroll Software

Manage Companies

Set up multiple companies within your organisation and manage payroll.

Stay Compliant

Payroll stays compliant with EPF, SOCSO, EIS, and LHDN requirements by updating.

Integrate with UBS

Seamlessly integrate your Access UBS Payroll data with Access UBS Accounting.

HRMS Capabilities

Employees easily request leave and submit claims. Appraisals streamlined with the HRMS.

Analyse Your Payroll

Harness the power of Access Analytics for insights on your workforce and payroll.

Enable Flexible Payroll

Access UBS Payroll’s mobile license feature enables users to access the system.

Pay Employees On Time

Track & manage each employee’s pay while computing bonus and incentives.

Store Employee Records

Centralise employee data – number id, personal information, salary, EPF contribution and more.

More Benefits

Benefits of a modern payroll software

Our payroll management software is trusted by over 4,000 companies across Asia to deliver payroll tasks and processes.

Stay Compliant

Let us keep you up-to-date with latest payroll legislation changes across 7 Asian countries with our frequent product updates.

Reduce Payroll Admin

Automate tax calculations and employee payslips to save time and reduce errors caused by manual calculations.

Payroll, Anytime, Anywhere

Effectively handle payroll remotely anytime, and any location.

Secure & Confidential

Keep details of your employee salary secure with authorisation processes and multiple layers of data security.

Manage Payroll & Leave Correctly

Accurately calculate your employees’ payroll, including government deductibles, and leave.

Locally Developed, Locally Support

Have a question or need help? In addition to our online Knowledge Base articles and product e-learning, our local support teams are here to address your issues quickly.

Powering success at any business size

The Access Group has a diverse range of payroll solutions designed to streamline your processes, engage your workforce and deliver greater visibility to your teams.

Best suited for up to 500 employees

EasyPay

Award-winning leading payroll software solution that helps businesses across the country perform more efficiently.

Best suited for up to 100 employees

UBS Payroll

Simplify your payroll processing and stay compliant. Integrate with other modules in the UBS product suite.

Award-winning Payroll

Winner of Best Payroll Software at HR Vendors of the Year Awards Singapore.

Best Payroll Software (Bronze) 2019

Best Payroll Software (Bronze) 2020

Best Payroll Software (Silver) 2021

Best Payroll Software (Silver) 2023

UBS Payroll Software Matrix

UBS Payroll Software FAQ

Provides insights into common queries about inventory management processes and tools.

What does payroll software do? / About Payroll Software

Payroll software is an on-premises or cloud-based solution that helps you manage, maintain, and automate employee payments. Integrated, and well-configured payroll software helps businesses of all sizes comply with tax and other financial regulations and reduce costs.

Why do you need payroll software?

Payroll software provides multiple advantages to an organisation vs manual processing. It helps work out payroll calculations and deductions quicker, generate accurate payslips, calculate bonuses, expenses, holiday pay, and so much more with minimum effort.

Additionally, when the payroll software is up to date and compliant with the government, it helps to ensure that the filing of employment taxes is in order. Overall, it helps save a lot of cost and time VS manual processes.

What does payroll software do for your business?

Payroll software helps to cut down any manual execution time that HR professionals need to do, allowing them to focus on the more strategic side of the business. It also allows businesses to focus on analysing the data provided by the software to make better decisions for both short- and long-term goals.

Good payroll software can help you as a business from the early stages of your organisation to the later stages as you scale your business. A scalable software like that provided by The Access group, would ensure you do not need to spend or change your software multiple times as your business grows.

Contact us to learn more about our payroll software.

What Are the Benefits of Payroll Software for Malaysian Businesses?

Payroll software offers numerous benefits for businesses in Malaysia:

- Compliance: Ensures compliance with Malaysian labor laws and tax regulations, reducing legal risks.

- Efficiency: Streamlines payroll processing, saving time and reducing administrative burdens.

- Accuracy: Minimizes payroll errors and discrepancies, leading to precise salary calculations.

- Tax Management: Helps manage complex tax calculations and filings according to Malaysian tax laws.

- Direct Deposit: Facilitates secure and convenient salary payments through direct deposit.

- Employee Self-Service: Allows employees to access pay information and tax forms easily.

- Customized Reporting: Generates payroll reports tailored to Malaysian business needs.

- Data Security: Ensures the security and confidentiality of payroll data, critical for compliance with data protection laws.

How Does Payroll Software Ensure Compliance with Malaysian Labor Laws?

Payroll software typically includes features that help ensure compliance with Malaysian labor laws, such as:

- Tax Calculation: Accurately calculates employee income tax, EPF, and SOCSO contributions according to Malaysian tax rates and rules.

- Statutory Deductions: Automatically deducts mandatory contributions and deductions as required by Malaysian law.

- Reporting: Generates statutory reports and forms necessary for compliance with local labor regulations.

- Updates: Keeps the software up-to-date with changes in Malaysian labor laws and tax codes to maintain compliance.

Is Payroll Software Suitable for Small and Large Malaysian Businesses?

Yes, payroll software is suitable for businesses of all sizes in Malaysia, including small and large enterprises. It offers scalability, allowing organizations to start with the features they need and expand as they grow. This flexibility makes it accessible and cost-effective for businesses of various scales.

Is there any trial version?

We can install free 30 days trial version or 500 transactions whichever come first, without any obligation from you.

How many company can UBS Payroll software support?

You may create un-limited companies for all UBS Payroll software.

Is the software license lifetime?

Software license is valid for lifetime but bear in mind that some old UBS versions may not compatible with new MS Window version.

What is Access Cover (Sage Cover)?

Optional yearly Access Cover subscription is for user to enjoy free upgrade and other benefits. 1st year Access Cover is free.

What if I do not renew Access Cover?

If you do not renew Access Cover, you still can use the software existing version forever without upgrade.

What do you mean by single user?

Single User can only be installed to one PC or laptop. You can purchase additional concurrent user for Local Network User.

Does UBS Payroll support cloud?

UBS Payroll Software is a desktop on-premises Window application but we can host it on cloud with a yearly fee allowing remote access from anywhere, anytime.

What is a mobile license?

Free mobile license for valid Access Cover allows user to temporary transfer license from office PC to home laptop or vice versa.

What is the different between Payroll 15, 30, 60, 100, 150 and Premium?

Payroll 15 limited to 15 employees per company, 30 limited to 30 employees and so on while Payroll Premium support unlimited emloyees.

Do you provide training and assistance whenever we encounter issues?

We do provide on-site or online training by experience consultant and support maintenance contract for a fee.

Can I transfer license to another PC or laptop?

You can transfer license from one PC or laptop to another in 2 ways namely:-

a. De-activate exiting PC and re-activate new PC anytime by yourself within minutes if existing PC still intact.

b. Re-issue license with filled-in form forwarded to our principal to manually de-activate license within 4 office hours.

Both methods entitle free 3 times per year for valid Access Cover and one time for expired Access Cover less than 4 years. Admin charges will be impose for additional transfer. Access Cover expired more than 4 years require upgrade with a fee to transfer license.